For the average Indian, our 20s and 30s are eventful times; “quite happening”. A lot happens during these years—people graduate, get their first jobs, some get married too, and most youngsters get trapped in the loop of overspending and trying to save money at the same time. Wouldn’t you agree?

At the same time, we start to explore investment options and typically end up at dividend stocks or mutual funds, even crypto more recently. We do look at real estate from one tiny corner of the eye but generally avoid it considering the high-end ticket sizes.

While the average minimum capital required to invest in residential property ranges anywhere between ₹50–70 lakh, investing in commercial real estate is typically beyond the reach of a retail investor, generally valued at ₹25–30 crore. (Source)

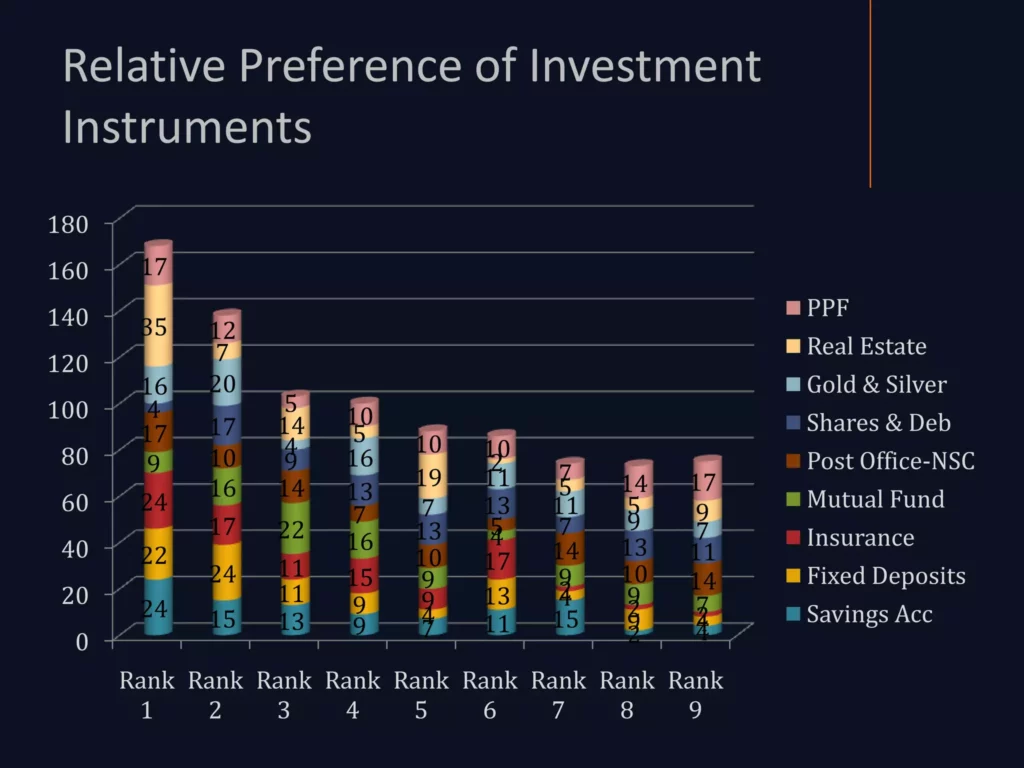

Source: Mike Abraham Business Research

But, it’s also true that our 20s and 30s are the most ideal time to start investing in real estate. Why?

Real estate is by no means a “get rich quick” scheme. People invest in real estate for the long-term value appreciation of a property. As the wise saying goes, “Time affords many things”, and it couldn’t be truer when it comes to property investment. In most cases, well until something drastic occurs, the longer we hold the property the better the returns are (owing to factors like compounding, amortization, etc.).

Towards the end of our 20s, we do strive for a certain term called ‘Financial Freedom’. And undoubtedly, real estate investment can play a major role in accomplishing that.

Millennials, who make up 36% of the nation’s population with a spending power of more than $330 billion, have entered the real estate market, accounting for 54% of home buyers by 2023. (Source: Times of India)

In the words of a genius:

“Compound interest is the eighth wonder of the world. He who understands it, earns it.

He who doesn’t, pays it.”

~ Albert Einstein

Compounding simply means earning interest on both your initial investment and the interest levied on that investment year after year. It really is a miracle.

And to enjoy the sweet pleasures of compounding, you must hold your investment for a longer period. Let’s understand this through an example.

Ayaan invests ₹10,000 at an interest rate of 8% for 5 years → ₹14,693.

If he holds it for 15 years → ₹31,721.

His investment more than tripled!

Unless you’ve been living under a rock for the last 100 years, you will be aware of the tremendous appreciation rate of real estate properties. That’s why it’s such a popular investment option.

So, if you’ve seen people regretting why they didn’t buy a plot or a property in the 90s or early 2000s, you’ll know why you should invest in your 20s and 30s.

Break-even occurs when:

Total Income = Total Expenses

Commercial and residential real estate turn profitable faster if you invest early. Imagine reaching 45 with all loans paid off and enjoying pure cash flow—versus starting late and still paying EMIs into your 50s.

Nothing teaches better financial discipline than real estate investing. You learn:

“Yeah yeah, we get it. But as youngsters, we don’t have that kind of capital.” That’s the whole purpose of this blog — to show that you can invest young.

REITs own malls, offices, warehouses, etc. Think of them as **mutual funds for real estate**—easy entry, low capital, diversified.

A property worth ₹1 crore can be split into 100 units. You buy units, earn rental income, and benefit from appreciation.

Blockchain ensures transparency and secure transactions. PropFTX enables fractional investments starting at just ₹35,000.

Buy → Renovate → Sell → Profit. A great option for hands-on investors seeking short-term gains.

These investment options are accessible, flexible, and realistic for young Indians. Fractional ownership strikes the perfect balance—shared risk, shared rewards, and direct alignment with property appreciation.

To get more investment tips and stay updated, visit PropFTX and sign up for our newsletter.

Cheers!