In the past, real estate investing was often seen as a privilege of the wealthy. Buying an apartment or a commercial space required huge capital, legal processes, and significant time. But that’s no longer the case.

With fractional real estate, investors can now buy into Grade-A commercial and residential properties at affordable entry points. And with platforms like PropFTX, you can now diversify your real estate holdings—just like a stock portfolio—smartly, strategically, and digitally.

This guide explains how to build a balanced, diversified real estate portfolio using fractional ownership through PropFTX.

Fractional real estate investing allows multiple investors to co-own a high-value property by investing smaller amounts. Each investor owns a fraction of the total asset, proportionate to their contribution.

Example: A ₹10 crore property is divided into 100 equal shares of ₹10 lakh each. Investors can buy as many shares as they like based on their budget and earn proportionate income and appreciation.

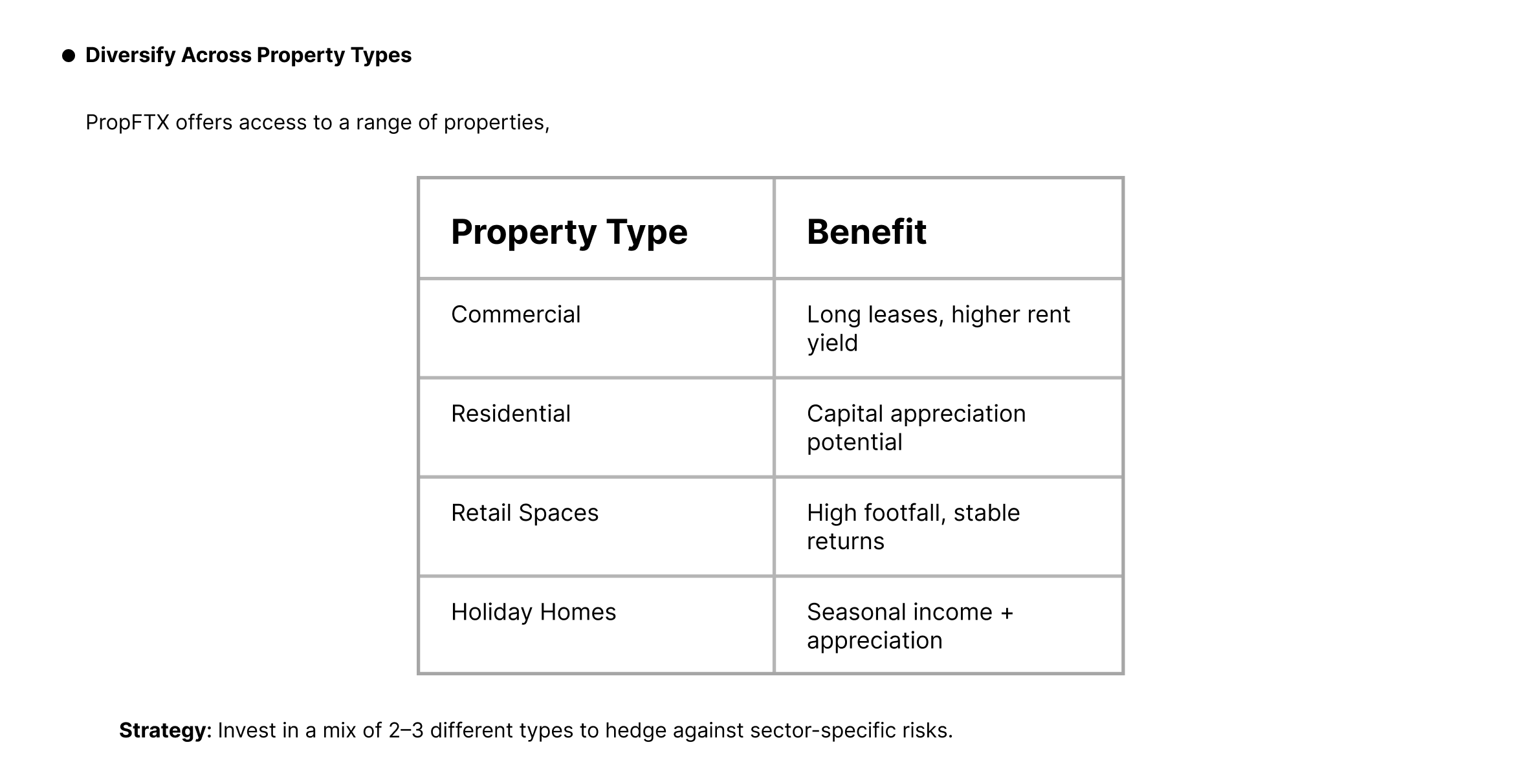

Diversification isn’t just for stocks — it’s equally powerful in real estate. Instead of putting all your money into a single property, you can spread your capital across different asset types, locations, and yield profiles.

Location drives real estate performance. The key to stability lies in geographic diversification — balancing metro properties with fast-growing Tier-2 and tourist cities.

Suggested Mix:

Combine core rental assets with growth-oriented properties for a well-rounded portfolio.

Example via PropFTX:

Start small and scale strategically. Fractional ownership starting from ₹25,000 helps you:

Transparency and governance are key. Always choose platforms that ensure:

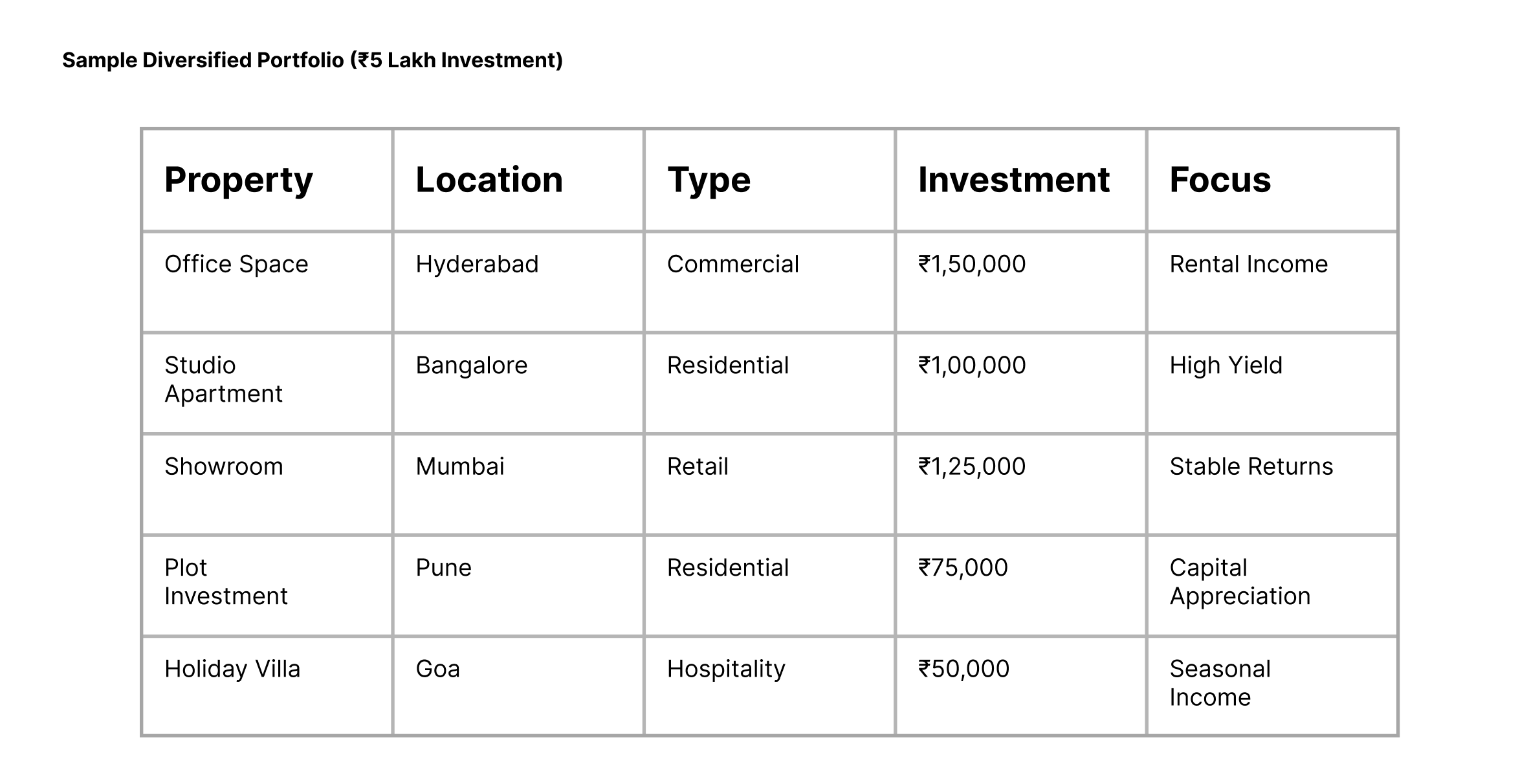

This sample portfolio shows how ₹5 lakh can be spread across different property types, cities, and risk levels to deliver stable returns with upside potential.

Fractional real estate investing has revolutionized how individuals approach property investment. You no longer need to manage tenants or block crores of rupees. With PropFTX, you can build a professionally managed, diversified portfolio in minutes.

Whether you’re focused on monthly income, long-term appreciation, or multi-city exposure, PropFTX gives you the tools to align your portfolio with your financial goals.

In 2025 and beyond, diversification is no longer optional—it’s essential. Fractional real estate investing lets you balance risk, maximize returns, and participate in India’s most lucrative real estate opportunities—without complexity.

With PropFTX, you can invest confidently, transparently, and intelligently.

Start small. Think big. Diversify smartly.

Subscribe to our blog for the latest investment insights and opportunities. Explore previous articles here.