Let’s be honest — when you think of commercial real estate, your first thought might be: “Sounds great, but I’m not Mukesh Ambani.” Office towers, retail shops, and glass-fronted business parks have always felt out of reach for most salaried professionals.

But times are changing — fast.

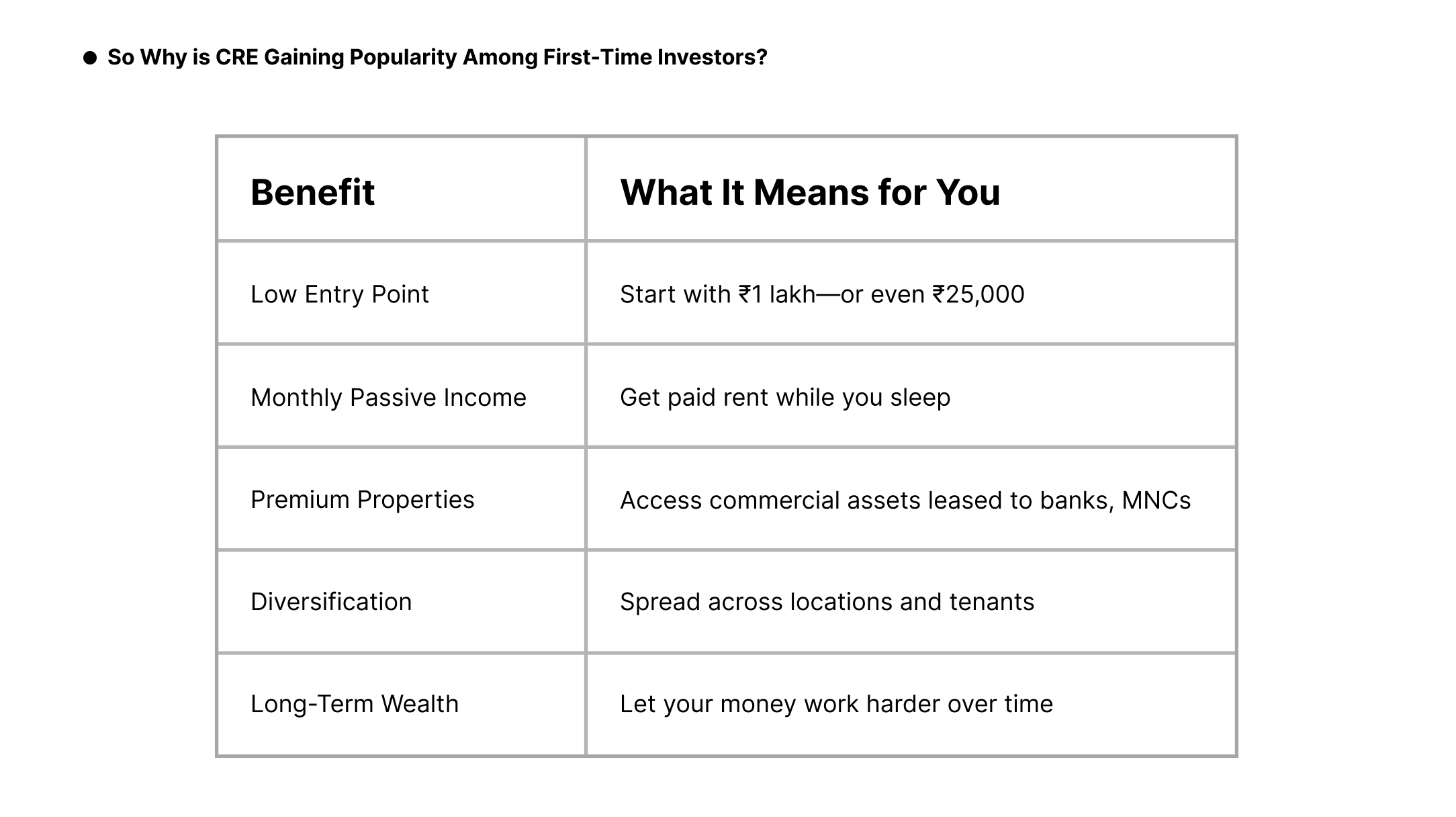

Thanks to fractional real estate platforms like PropFTX, even working professionals can now invest in Grade-A commercial properties starting from as little as ₹25,000. No brokers. No late-night tenant calls. No scouting for deals over weekends.

Sounds too good to be true? Let’s walk you through exactly how it works.

Simply put, Commercial Real Estate (CRE) refers to income-generating properties such as office buildings, co-working spaces, warehouses, or retail outlets.

Think of the HDFC branch near your home or that buzzing WeWork in Indiranagar — both are examples of CRE. These spaces are leased by companies for 5–10 years, generating consistent monthly income for the owners.

CRE tends to outperform residential real estate because it’s driven by long-term leases and corporate-grade tenants, not emotional buying.

Let’s be real — CRE investment used to feel impossible for most of us.

So most professionals stuck with FDs, SIPs, or mutual funds and hoped for the best.

Fractional real estate changes everything. It’s like crowdfunding, but for property.

PropFTX divides a property into smaller ownership units. You buy one or more units and become a co-owner of a premium commercial property.

Example: A ₹5 crore property is divided into 100 units of ₹5 lakh each. You invest ₹5 lakh, and now you own a fraction of a high-value property leased to a national tenant. Just like that — you’re in the commercial real estate game.

Each month, you earn your share of rent — directly proportional to your investment.

Example: Invest ₹1,00,000 in a property yielding 9% → you earn ₹9,000/year, or ₹750/month — without lifting a finger.

Over 4–6 years, property values rise. When the property is sold, you earn your share of the profit.

Example: A ₹1,00,000 stake growing 30% becomes ₹1,30,000 — plus rental income throughout. That’s growth and income — a combination few traditional assets offer.

Forget the paperwork and tenant calls — PropFTX handles it all:

Yes — absolutely.

Every property listed on PropFTX undergoes rigorous checks before being made available to investors:

In short, you’re never left guessing where your money is or how it’s performing.

Ravi, 30, works in IT and earns ₹18 lakh per year. Instead of leaving his money idle in FDs, he tried PropFTX and invested ₹5 lakh in a property leased to a national bank.

Now he invests every quarter, building a steady passive income stream.

Commercial real estate isn’t just for the ultra-wealthy anymore. With PropFTX, salaried professionals can now:

If you’ve already secured your SIPs, insurance, and emergency fund, it’s time to let your money own a corner office too.

Start small. Stay smart. Grow big.

Subscribe to our blog for insights on optimizing not just your time — but your investments. Explore previous blogs here.