The real estate industry in India is the second-largest employer and is predicted to contribute nearly 13% of the country’s GDP by 2025. With the growing disposable income of the middle class—which forms the largest chunk of the population—India continues to rank among the top 10 appreciating real estate markets globally. (Source: Seedwill.co)

Add to that the fact that India has one of the youngest populations in the world (average age: 29). The real estate market is ripe, growing, and full of potential investors.

However, the challenges are real. Investors today face:

Many buyers aren’t even sure if the property they want is legally sound or free of encumbrances. And for young Indians in their 20s and 30s, the high entry barrier is the biggest roadblock.

That’s where PropFTX stepped in—designed by founders who wanted to solve these real issues, one by one.

Traditionally, residential real estate demands an upfront investment of ₹50–70 lakh (Financial Express, 2021). Commercial real estate (CRE) is even further out of reach, typically valued at ₹25–30 crore. Even existing fractional CRE platforms often require a minimum of ₹15–25 lakh. (Source: Outlook Business)

Rajeev Chhabra, Founder & CEO of PropFTX, explains:

“We knew real estate is a high-value transaction, so the first question was: how do we make the ticket size smaller?”

And that’s exactly what PropFTX achieved—fractional ownership starting at as low as ₹35,000 for residential properties.

Fractional ownership allows you to buy a portion of a high-value asset and receive returns proportional to your investment—both rental income and appreciation.

The platform divides the property into smaller, purchasable units/tokens, making real estate accessible without requiring full ownership.

One of PropFTX’s strongest value propositions is its AI valuation model, which evaluates past rates, micro-location factors, demand cycles, and 10-year projections to determine the most accurate price.

Liquidity is a major challenge in conventional real estate—finding the right buyer, negotiating, and completing paperwork can take weeks or even months.

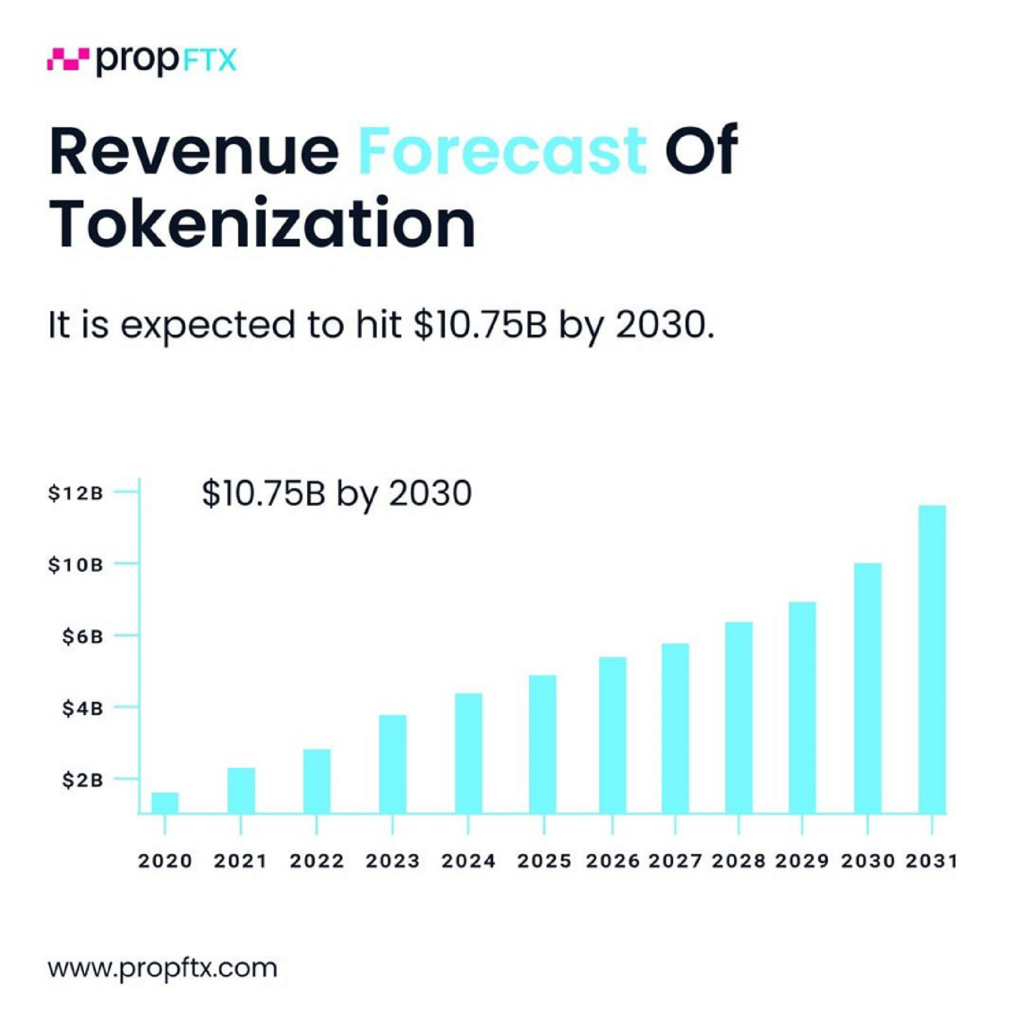

PropFTX solves this through tokenization. Real estate tokenization converts property ownership into digital tokens— each representing a small share of the asset.

These tokens can be traded digitally, ensuring smooth entry and exit for investors.

“The platform architecture is built to run 24×7, allowing investors to trade anytime, from anywhere.”

— Varun Singhi, Co-Founder & Strategy Head

Blockchain is a decentralized digital ledger ensuring transparency, immutability, and enhanced security. Every operation on the blockchain uses cryptography, eliminating fraud, manipulation, and dispute risks.

“Once we introduced fractionalization, blockchain was the obvious next step—it solved transparency and security in one go.”

— Rajiv

As Rajiv explains, “We are among the first platforms to offer scientifically derived pricing based on long-term property data. Our AI model analyses the last 10 years of data along with future projections to determine the ideal price of a property.”

This ensures PropFTX users invest in assets with real potential, backed by robust data—not guesswork.

The model also protects transaction sanctity by removing unnecessary middlemen and providing transparent pricing.

The PropFTX team conducts additional due-diligence—beyond the builder’s legal review—before onboarding any property. Only properties with strong investment potential make it to the platform.

Millennials, who make up 36% of India’s population and hold over $330 billion in purchasing power, accounted for 54% of all property buyers in 2023. (Source: Economic Times)

People in their 40s seeking passive income and asset-backed security also make up a major investor group.

“We verify Proof-of-Address, Proof-of-Identity, selfie match, bank verification, and AML checks against 1000+ global sanction lists.

Our KYC is fully in line with RBI guidelines and is extremely fast.”

— Varun Singhi

Despite limited awareness, fractional real estate is rapidly becoming one of the most powerful investment alternatives in India.

Whether you're a newcomer or a seasoned investor, PropFTX offers a flexible, transparent, and accessible path into real estate ownership.

To stay updated with insights, tips, and market trends, explore PropFTX and sign up for our newsletter.

And while you're at it, browse the listed properties and minimum investment amounts available on the platform.