For Indian investors in 2025, fractional real estate can absolutely be worth it — especially if you want exposure to rental income and property appreciation without the burden of full ownership.

The upside is straightforward: you earn from rent and capital growth. The challenge lies in trusting the platform and committing to medium- to long-term holding periods. Choosing a regulated, transparent, tenant-focused platform is critical.

Treat fractional investing as a 3–7 year play, not a quick flip. Always review projected returns, fee structures, and risk factors before investing.

Fractional real estate means co-investing in Grade-A properties along with other investors. You own a share of the property via a Special Purpose Vehicle (SPV) or the newer SEBI SM REIT structure.

You earn:

How it works:

Entry ticket sizes have now fallen to ₹5–10 lakh for many deals — widening access for young professionals, NRIs, and first-time real estate investors.

India’s fractional market is already pegged at $500–600M and growing rapidly with regulatory clarity.

The underlying concept is always the same: many investors pool capital → buy a property → share returns. But the legal wrapper affects transparency and governance.

The investment is the same — co-ownership. The difference is in regulatory oversight. SM REITs offer more standardisation; SPVs depend on platform credibility.

PropFTX, India’s first fractional real estate platform, makes it possible in three steps:

Create your PropFTX account, upload ID documents (PAN, Aadhaar, Passport), and complete verification to begin investing.

Explore available properties — commercial, residential, or plots. Review:

Pay via UPI, net banking, or card. Once allotted, you become a co-owner via SPV or SM REIT. Track rent, valuation, and exits through your dashboard.

Bengaluru saw a 79% price increase in five years — proving how strong appreciation can uplift IRRs beyond rental yield alone.

Under the SEBI SM REIT regime, completed and leased assets offer stability but remain dependent on tenant quality and lease structures.

Most reputable listings begin at ₹5–10 lakh. Smaller tickets enable you to:

Every PropFTX property is vetted across all eight parameters before listing.

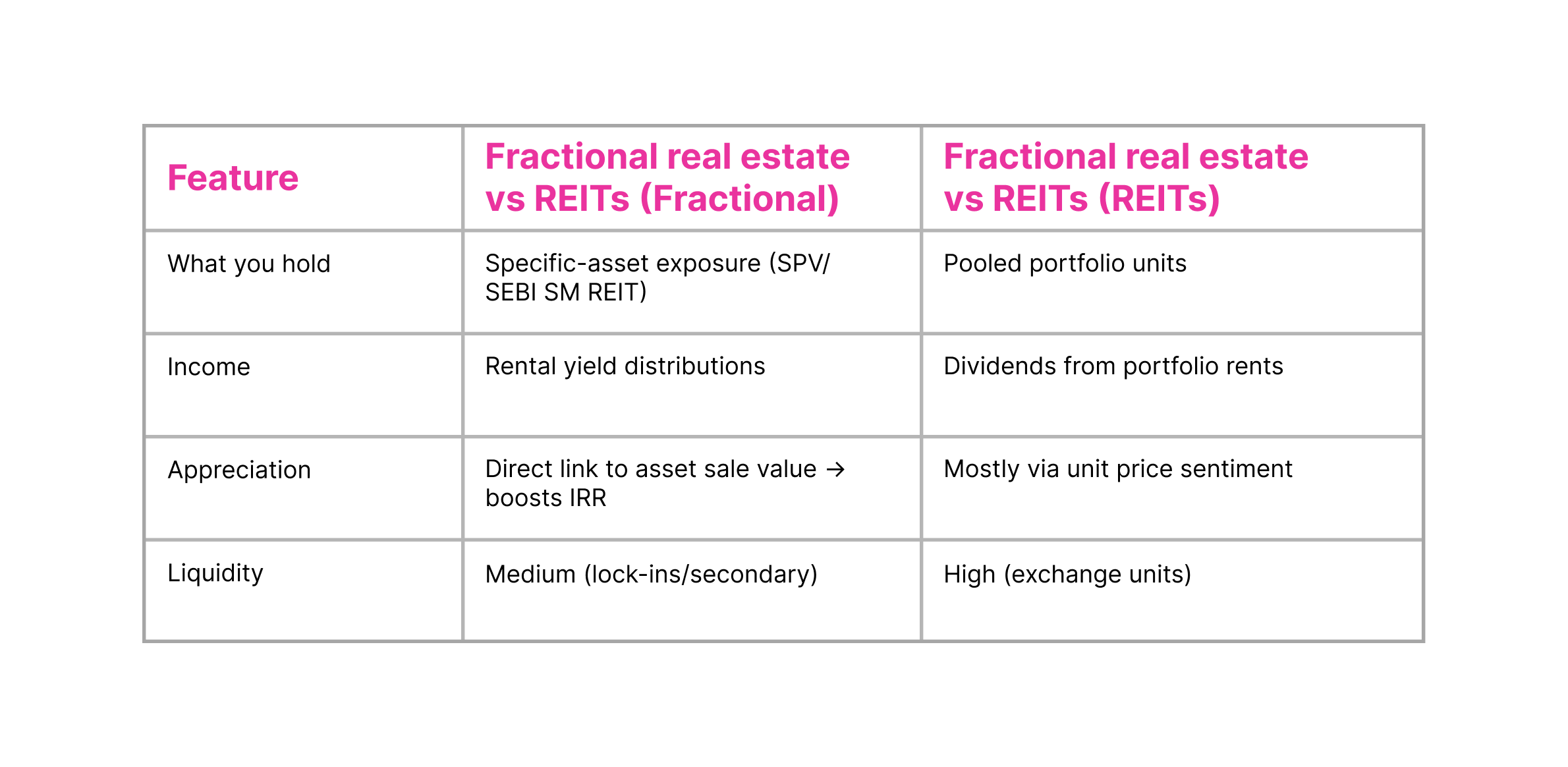

Here’s the exact comparison for 2025:

Read our detailed breakdown: Fractional Real Estate vs REITs (2025)

Taxed at your slab rate as additional income.

Under the 2024–25 regulatory framework, fractional real estate is a strong medium-term entry point — provided asset selection is conservative.

Explore Grade-A properties vetted by experts at PropFTX.com.

India’s fractional market could grow into the billions over the next decade as SEBI SM REIT adoption accelerates.

Yes — especially if you start small (₹5–10 lakh), diversify, and stick to completed, leased assets.

3–4% for residential; 7–9% for commercial; IRR depends on appreciation.

Yes. SPVs, SM REITs, and REITs have different tax treatments. Consult a tax advisor.

3–5 years minimum for optimal rental + appreciation cycles.

Yes — fractional real estate is FEMA-compliant with proper onboarding.

No — timeshares offer usage; fractional offers real ownership + rental income + sale proceeds.

Platform or professional managers handle tenants, maintenance, rent, and compliance.

Rent may pause until re-leased. Strong platforms mitigate this through tenant selection and active leasing teams.