When it comes to building wealth, selecting the right asset class is just as crucial as learning more. Today’s investors — from seasoned professionals to ambitious millennials — are looking beyond traditional FDs, stocks, or gold.

They’re asking one key question:

“Where can I invest smarter, earn passively, and still manage risk?”

PropFTX answers that call — by unlocking access to fractional ownership in premium real estate and making what was once reserved for the ultra-rich accessible, transparent, and rewarding for modern investors.

Imagine owning a slice of a commercial office tower in Mumbai or a warehouse leased to a top logistics firm — without needing to invest crores. That’s fractional ownership.

At PropFTX, multiple investors co-own institutional-grade real estate assets. You invest a fraction (typically ₹10–25 lakhs) and, in return, earn rental income and benefit from capital appreciation over time. All assets are fully managed and professionally operated, giving you a truly hands-free investment experience.

Here’s why PropFTX’s fractional real estate model is gaining ground as a credible, performance-oriented investment class:

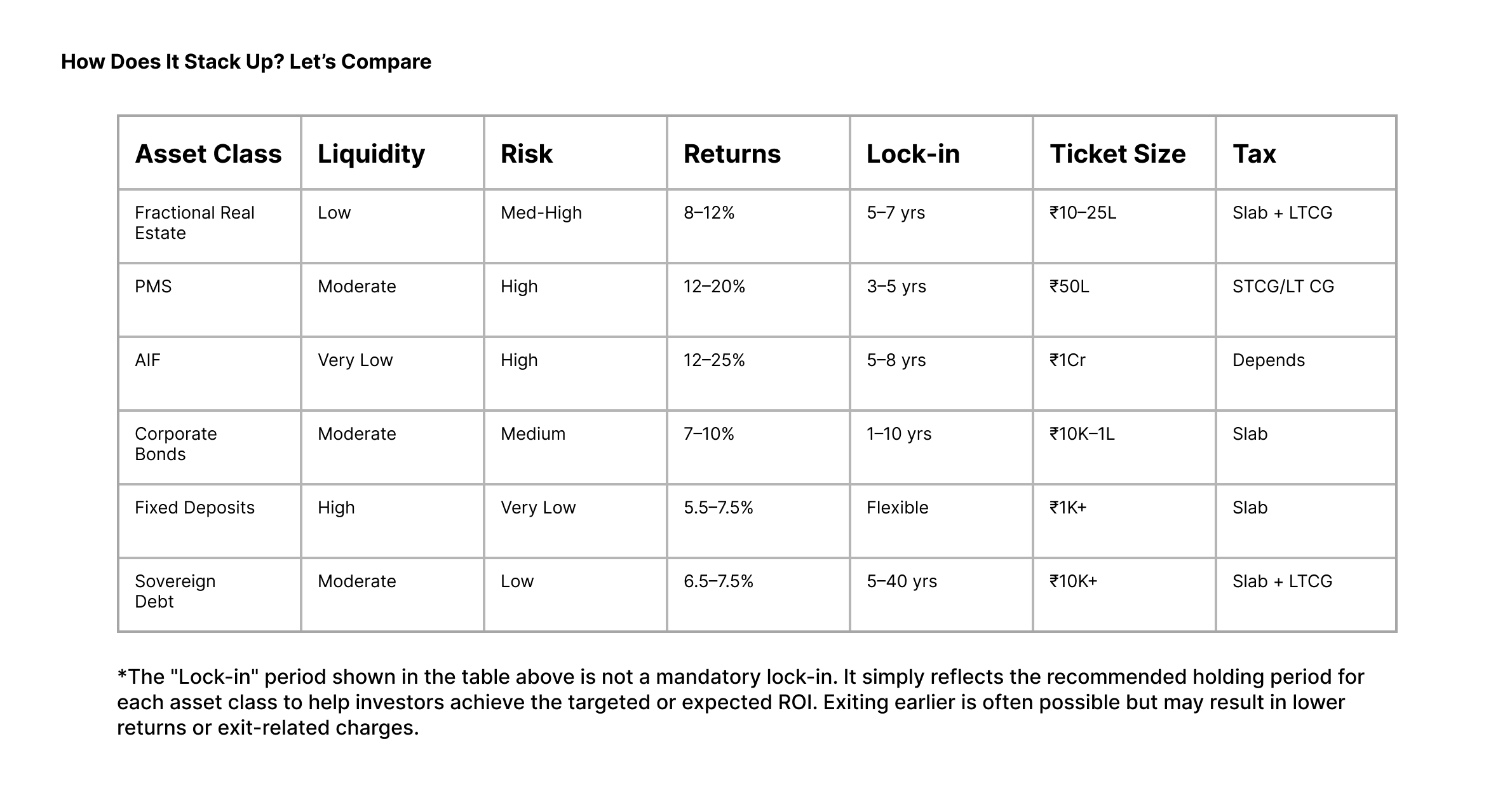

Yes, there’s a medium-term lock-in and lower liquidity — but that’s the trade-off for an asset that offers real-world value, predictable income, and robust portfolio diversification.

PropFTX is built for today’s discerning investor. Whether you’re a first-generation wealth creator or an HNI seeking balance, fractional real estate can be a powerful addition to your portfolio.

It’s ideal for:

At PropFTX, we’re not just enabling fractional investing — we’re reimagining how India invests in real estate. With a tech-first approach, curated opportunities, transparent structures, and professional asset management, we help investors:

In a world of algorithm-driven markets and volatile returns, fractional real estate through PropFTX stands out — offering tangible value, predictable income, and long-term security.

As the ecosystem matures and secondary markets expand, fractional real estate is evolving from an “alternative” asset to a core investment class for next-generation investors.

Subscribe to our blog for the latest PropFTX insights on fractional ownership, investment trends, and portfolio diversification.

Ready to explore fractional real estate? Let PropFTX be your partner in smarter, data-backed real estate investing.