Most Indians know mutual funds, fixed deposits (FDs), and gold. What’s missing is deeper awareness about real estate investing. The options are evolving fast, and two terms dominate conversations today:

Both allow investors to access high-value real estate without needing crores — but they’re fundamentally different. Let’s break down Fractional Real Estate vs REITs for Indian investors in 2025.

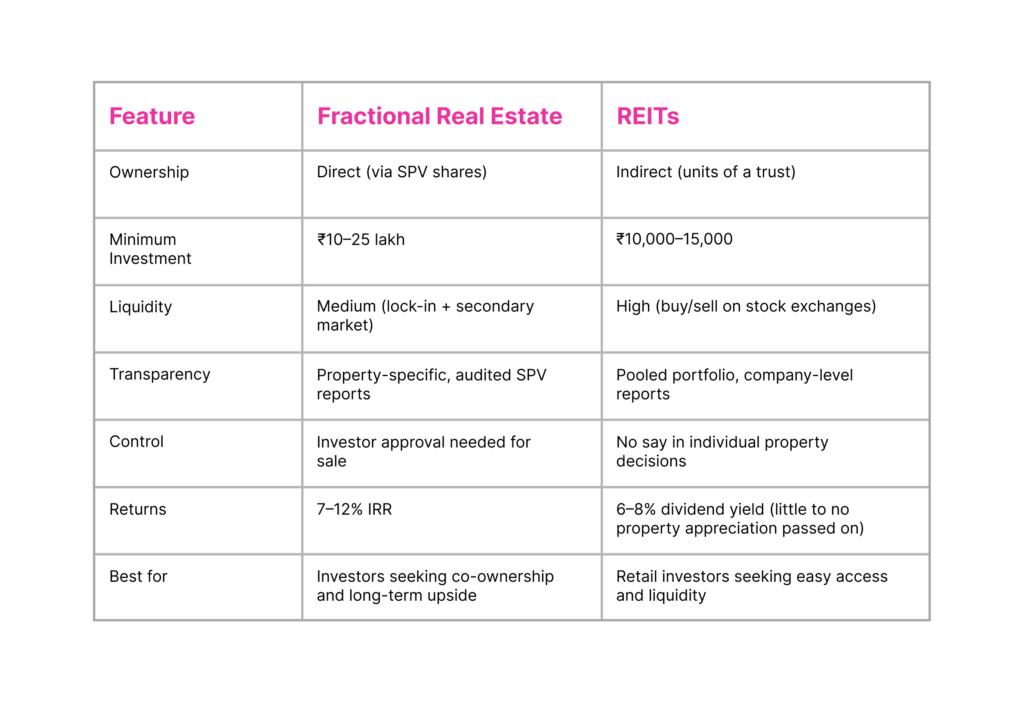

A Real Estate Investment Trust (REIT) works like a mutual fund for real estate. You buy units listed on the stock exchange, and the REIT pools investor capital to purchase and manage commercial assets — offices, malls, or warehouses.

The income generated from rent is distributed as dividends. REITs are:

Fractional Real Estate enables investors to directly co-own a premium property through a Special Purpose Vehicle (SPV). You pool funds with other investors to purchase a specific commercial asset and earn rental income in proportion to your shareholding. When the property is sold, you also receive a share of the capital appreciation.

Fractional REs are:

In Fractional Real Estate, the property belongs to an SPV. If shareholders decide to sell, the asset is liquidated and proceeds are distributed according to ownership. Investors directly gain from both rental income and capital appreciation.

In REITs, the trust owns the properties — not the investors. When a REIT sells an asset, investors don’t receive a direct share of the proceeds. The REIT manager may reinvest or distribute part of the profit as dividends. Your upside is tied to the unit price on the stock exchange, not directly to the property value.

Fractional Real Estate typically offers:

REITs in India generally yield 6–8% per year via dividends from pooled rental income. While REIT prices fluctuate with the market, they offer high liquidity and stable returns, though with limited upside compared to Fractional RE.

The right choice depends on your goals:

Both Fractional Real Estate and REITs have their unique benefits.

REITs provide easier entry and exit, regulation, and liquidity — ideal for smaller investors. Fractional Real Estate delivers higher returns, control through ownership, and stronger upside over time.

Rather than “Fractional Real Estate vs REITs,” smart investors see them as complementary strategies. Use REITs for short- to medium-term liquidity and redirect profits into Fractional RE for long-term portfolio growth.

Got questions? Visit propftx.com to speak with an expert today.